Owning a home is a cornerstone of the American dream, yet for many, traditional banking creates a significant ethical dilemma. LARIBA Interest-Free Home Financing offers a refreshing alternative that aligns your property goals with your deeply held spiritual values. By choosing this Faith-based Financing model, you avoid the pitfalls of predatory lending while securing a stable future for your family.

This system operates as an Ethical Partnership Model, ensuring that your path to ownership is transparent, fair, and completely Riba-Free Housing. Whether you are a first-time buyer or looking to refinance Interest-bearing Debt, LARIBA provides a sophisticated, Shariah-compliant solution tailored for the modern US housing market.

For those exploring Shariah-compliant banking in the United States, you can check out our List of Islamic Banks in USA for a complete guide.

As It Is: What is Interest-Free Home financing and how does it actually Work?

Traditional banks usually lend you money and then charge you for the time you use it. LARIBA operates differently because they function as a partner who buys the property alongside you. This Co-ownership Agreement means both parties share the risks and the rewards of the investment. You are not a borrower, as in fact, you are a co-investor in a real physical property. Suppose that you come across a house in a quiet suburb, where the price is contained in $400,000.

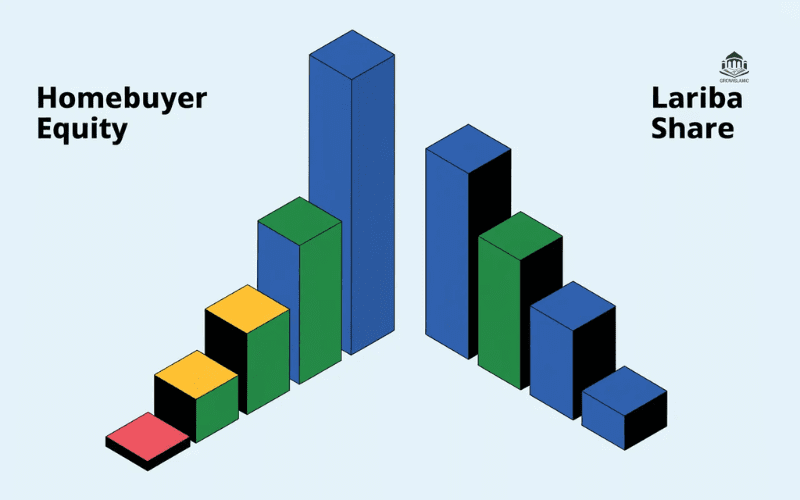

Instead of taking a loan, you and LARIBA purchase the home together as partners. You might contribute a 20% Down Payment Requirements amount while LARIBA provides the remaining 80%. This creates a Mudaraba & Musharaka relationship where you both own shares of the physical structure. This Principal Repayment process allows you to gradually buy back LARIBA’s shares over time.

The Concept of “Declining Participation in the Usufruct” (DPU)

DPU is sophisticated way of saying you are buying the Usufruct (Right to Use) from the bank. LARIBA acts as your partner in a Diminishing Musharaka style arrangement. As you make payments, LARIBA’s share of the home gets smaller while your ownership stake grows larger. This ensures a fair transfer of rights without the need for traditional interest-based lending.

Why We Use Market Rent Instead of Interest Rates

LARIBA uses Rental Value Benchmarking to determine the cost of living in the home. You and the bank look at local listings to find a fair price for the area. This Mudaraba & Musharaka approach ensures the profit is tied to the real economy. It’s a more honest way to value the “service” of the home rather than the “cost” of the money.

Is LARIBA Truly Shariah-Compliant? Addressing the Riba Question

Many skeptics wonder if these programs are just hidden interest under a different name. However, the Shariah Supervisory Board ensures that every contract avoids the pitfalls of exploitation. Similar Shariah governance frameworks are also applied in halal investment funds and sukuk markets globally. This isn’t just a linguistic trick because the risk is shared between the bank and the buyer. By following Halal Investment Standards, LARIBA creates a system that prioritizes community welfare over predatory lending.

The fundamental difference lies in the Conventional Mortgage vs. Islamic Finance structure. In a normal loan, the bank doesn’t care if the house burns down as long as they get paid. In this Faith-based Financing model, the institution shares the burden of the property’s physical existence. This makes the entire transaction more stable and ethically sound for every family involved.

The Role of the “LARIBA Agreement” Rider

A special legal document called a “rider” is attached to your standard closing paperwork. This rider modifies the language to ensure it follows the Shariah Compliance Certification requirements. It explicitly states that the transaction is a lease-to-own partnership rather than a debt-based loan. This protects your religious integrity while still satisfying the legal needs of the American court system.

Fatwas and Scholarly Endorsements

Reputable religious leaders from around the globe have reviewed this specific model. These Scholarly Fatwas provide the green light for Muslims to use this system in the West. You can rest easy knowing that experts in Islamic law have audited the books. They confirm that this path is a valid way to avoid interest while living in the United States.

LARIBA vs. Traditional Mortgages: Side by Side Analysis

| Feature | Conventional Mortgage | LARIBA Home Financing |

| Legal Basis | Debt / Loan | Co-ownership / Partnership |

| Profit Source | Interest (Riba) | Shared Rental Income |

| Risk Factor | Buyer takes all risk | Risk is shared between partners |

| Tax Treatment | Mortgage Interest Deduction | Mortgage Interest Tax Deduction |

| Schedule | Amortization Schedule | Amortization Schedule Alternative |

How to Qualify for Interest-Free Home Financing in 2026

The Pre-qualification Process is your first step toward getting the keys to your new front door. You will need to provide your tax returns and proof of income to the LARIBA team. They will look closely at your Credit Score (FICO) to see how you have handled money in the past. A high score shows that you are a reliable partner for this big investment.

LARIBA also checks your Debt-to-Income Ratio (DTI) to make sure you won’t be overwhelmed by payments. “You must also consider the Down Payment Requirements which usually range from 5% to 20%. Saving up a larger amount can help reduce your monthly rental payments significantly”. They also assist with Closing Costs & Escrow to ensure there are no hidden surprises at the end.

Credit Score and Financial Requirements

A strong Credit Score (FICO) is essential because it demonstrates your financial character. While the bank is your partner, they still need to know you are disciplined. You should keep your other debts low to improve your chances of a quick approval. This discipline is part of maintaining a healthy and successful halal home lifestyle.

The Step-by-Step Application Process

First, you’ll complete the Pre-qualification Process by filling out a simple online form to share your basic financial details. To stay organized, you should have these specific documents ready for the LARIBA team to review:

- Two years of your most recent Tax Returns and W-2 forms.

- Last 30 days of Pay Stubs or a Salary Certificate from your employer.

- Two months of complete Bank Statements for all accounts.

- A copy of your Driver’s License or Passport for identification.

- A written Gift Letter if family members are helping with your down payment.

Next, a professional Property Appraisal is conducted to ensure the home’s value is solid and worth the investment. LARIBA then performs a unique Rental Value Benchmarking review by researching the local market to establish a fair monthly payment. After everything is verified and the Co-ownership Agreement is finalized, you’ll sign the LARIBA Agreement rider at closing. This officially starts your journey toward total home ownership as you move into your new, Riba-Free Housing.

The 2026 Update: What the LARIBA and UIF Merger Means for You

The recent merger between LARIBA and University Islamic Financial is a huge win for you. This union has created a more robust system for Faith-based Financing across all fifty states. You now have access to better technology and faster processing times for your application. This partnership strengthens the available capital for the entire American Muslim community.

You will benefit from a wider network of professionals who understand both banking and Shari’ah. The combined expertise makes it easier to navigate complex local real estate laws. This merger ensures that Interest-Free Home Financing remains a stable and growing option for years to come. It’s a great time to start your home search with these extra resources.

Common Myths about Islamic Home Financing Debunked

One common myth is that this process is only for people of the Muslim faith. In reality, anyone can use LARIBA if they prefer an Ethical Partnership Model over debt. People of all backgrounds are choosing this path because it feels more honest and fair. Another myth is that it costs more than a standard loan, which isn’t always true.

Many believe that you don’t build equity as fast in a Fixed-rate Alternative system. However, your Home Equity Building moves at a similar pace to traditional loans. In fact, because you aren’t paying “front-loaded” interest, your ownership feels more tangible. You are truly buying a piece of the home every single month you stay there.

Tax Benefits and Legal Protections for Muslim Homebuyers

You might worry about losing out on the Mortgage Interest Tax Deduction at the end of the year. Luckily, the IRS recognizes the rental payments in this model as a deductible expense for many. This means you get the same financial breaks as your neighbors without compromising your soul. It’s a smart way to keep more money in your pocket while staying ethical.

Specific tax codes allow the “profit” portion of your payment to be treated like interest. This ensures that your halal home investment is as tax-efficient as any traditional mortgage. You also enjoy standard legal protections regarding property rights and fair housing laws. Your Co-ownership Agreement is legally binding and protects your family’s future in the United States.

Can I Refinance My Existing Usury (Interest) Loan with LARIBA?

Yes, you can definitely refinance Interest-bearing Debt into a halal partnership. This process allows you to move away from a traditional bank and toward a Shari’ah-compliant one. You will essentially “sell” your debt to the partnership and begin a new lease-to-own agreement. This is a popular choice for families who want to purify their existing financial holdings.

Consider a family who bought a home in 2022 with a standard bank loan. They now want to align their finances with their faith but don’t want to move. LARIBA can step in, pay off the old bank, and become your new partner. This transition is seamless and helps you achieve a truly Riba-Free Housing status without leaving your neighborhood.

Real Life Success Stories: Families Who Achieved Riba-Free Ownership

My friend the Zain Ali family from Chicago recently moved into their four-bedroom home using LARIBA. They were thrilled to find a way to own a house without touching interest. “We felt a huge weight lift off our shoulders,” Mrs. Zain said during her housewarming party. Their story is just one of thousands of examples of success in the USA.

Another family in Texas used the Refinance Interest-bearing Debt option to clean their finances. They had lived with a conventional loan for five years but felt uncomfortable with the interest. By switching to LARIBA, they began Home Equity Building with a clear conscience and a happier heart. These families prove that ethical financing is a practical reality for everyone today.

Conclusion: Taking the First Step toward Your Halal Home

Your dream of a halal home is much closer than you might actually think today. By choosing LARIBA Interest-Free Home Financing, you are building a lasting legacy for your family’s future. You can finally enjoy your living room knowing that every payment is fair, ethical, and spiritually sound. This Ethical Partnership Model ensures that you aren’t just a customer, but a valued partner in a Shariah Compliance Certification journey. It is not just four walls; it is about peace of mind that is gained by remaining faithful to your religion.

It is time to get this rewarding and adventurous life of real ownership on the road. Whether you are ready to apply or just starting the Pre-qualification Process, the team is ready to support your Home Equity Building goals. Imagine the joy of hosting your first dinner in a house that was purchased through Riba-Free Housing methods. This is your chance to participate in the housing market without compromising your values or your financial health. You deserve a sanctuary that reflects your heart, so take that brave first step today toward a Faith-based Financing future.

For more insights into Shariah-compliant financial solutions and interest-free banking across the United States, you can explore our comprehensive guide on Islamic Finance USA.

FAQs

How does LARIBA calculate my monthly payments without using interest?

LARIBA uses Rental Value Benchmarking to set payments based on local market rent instead of money-lending rates.

Is this financing model available for people of all faiths?

Yes, this Ethical Partnership Model is open to any homebuyer seeking a fair and transparent alternative to traditional debt.

Can I pay off my home earlier than the agreed schedule?

You can increase your Principal Repayment at any time without facing any hidden penalties or extra fees.

Will I still own the property title in my own name?

The Co-ownership Agreement ensures your name is on the title while legally protecting the interests of both partners.

Is LARIBA financing recognized by the IRS for tax purposes?

A number of homeowners are able to claim the Mortgage Interest Tax Deduction since the IRS considers such payments to be deductions.

How much is the minimum down payment?

Normal Down Payment Requirement is usually between 5 to 20 percent as per your financial profile.

Is LARIBA a source of financing commercial property as well?

Although Riba-Free Housing is their core business, they do have specific partnership model of different kinds of real estate.

How long does the approval process usually take?

The Pre-qualification Process and final approval generally follow a similar timeline to a standard bank closing.

Is LARIBA available in all fifty states across the USA?

Through University Islamic Financial (UIF), this faith-based financing model is widely accessible to families throughout the entire country.