In 2026, the landscape for home ownership has been revolutionized by the rapid expansion of the Halal Mortgage Nigeria 2026 sector. As the Central Bank of Nigeria implements new capital requirements, non-interest banks like Jaiz, TAJBank, and Lotus Bank have significantly bolstered their asset-backed offerings to meet rising demand. These organizations practice on moral principles with the Diminishing Musharakah framework to help in making sure that both the bank and the homeowner have equal shares of risk and reward.

With a Halal Mortgage Nigeria 2026 plan, you will be spared the uncertainty of the traditional interest rates, and take advantage of long-term and transparent partnerships with your financial interests in mind.

Introduction to Halal Mortgages in Nigeria (2026 Overview)

The Nigerian housing market is growing fast, and halal home financing is leading the way. Many people are tired of paying high interest, which is called Riba in Arabic. Instead, they want Riba-free housing finance that follows their personal values. This year, more non-interest banks in Nigeria are helping people move into their own homes. It is a fresh and honest way to handle home ownership financing Nigeria without the stress of debt.

You can read our detailed guide on Islamic banking in Nigeria to understand how non-interest banks operate under CBN regulations before applying for a halal mortgage.

You will find that these banks do not just lend you cash. They act like partners who want to see you succeed. This shift toward ethical home financing makes it easier for young families to start their journey. Whether you live in Kano or Port Harcourt, Islamic home finance Nigeria is now accessible to almost everyone. It is a reliable system that protects you from the sudden price jumps found in old-fashioned bank loans.

What Is a Non-Interest (Islamic) Mortgage?

A non-interest mortgage is a special way to buy property where the bank does not charge you interest. Instead of a standard loan, the bank uses Islamic financial principles to make a fair profit. They might buy the house and sell it back to you at a slightly higher price. This is known as a zero-interest housing loan because you are not paying back “rent” on the money itself. You are simply buying a real asset over time with a clear plan.

These banks follow strict rules to ensure everything is fair for the buyer. They often use Islamic contract structures to make sure the agreement is crystal clear. Unlike normal banks, non-interest financial institutions cannot charge you extra fees for paying late or being in trouble. This makes the whole process feel much more human and supportive. You are getting a Sharia-compliant mortgage Nigeria that treats you like a partner, not just a customer.

How Islamic Home Financing Works (Key Principles)

The way this works is very different from what you might see at a regular commercial bank. Most of these deals use asset-backed financing, which means there is always a real house involved. The bank might use a Murabaha home financing Nigeria model where they buy the home first. Then, they sell it to you at a fixed price that you pay back in small bits. This keeps your monthly budget safe because the price never changes once you sign the contract.

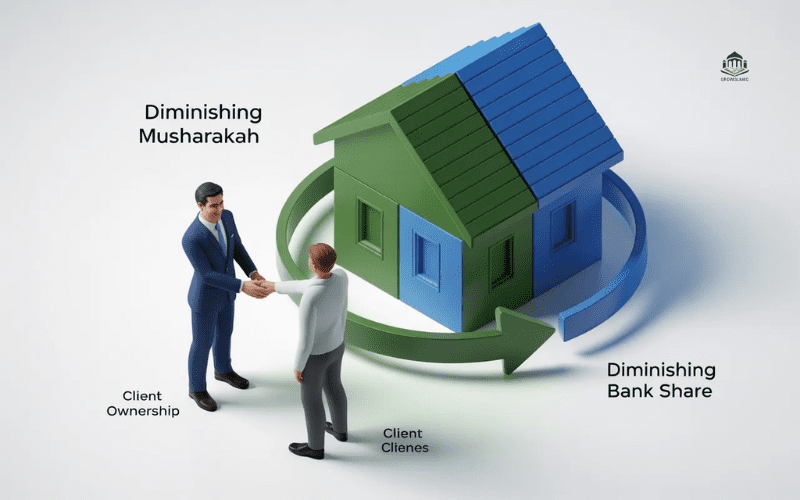

Another popular method is the Diminishing Musharakah model, where you and the bank own the house together. As you pay your monthly share, your portion of the house grows while the bank’s portion gets smaller. You also pay a small amount of rent for the part the bank still owns. This rent-to-own Islamic mortgage style is very popular because it feels natural. Eventually, you own 100% of the home, and the bank exits the partnership happily.

Benefits of Choosing a Halal Mortgage in Nigeria

One of the biggest perks is the total transparency you get from start to finish. You will never wake up to find that your monthly payment has doubled because of the economy. Ethical home financing ensures that both the bank and the buyer share the risks of the investment. This means the bank is very careful to help you pick a house that is actually worth the money. They don’t want you to fail because if you lose, they lose too. Also, these banks avoid any business that is harmful to society or the environment. This makes Islamic banking Nigeria 2026 a great choice for people who care about social justice.

You can also explore how Sukuk in Nigeria is helping fund ethical infrastructure projects through Sharia-compliant investment models. You get a zero-interest housing loan that is clean and focused on building a better community. Many users find that the Ijara mortgage Nigeria system gives them more flexibility than regular loans. It is a win-win situation where your home and your values live together in harmony.

Factors to Consider Before Applying for a Non-Interest Mortgage

Before you jump in, you need to look at your monthly income very carefully. Even though there is no interest, you still have to make a steady profit-sharing agreement payment. You should check the mortgage tenure options to see how many years you have to pay. Some banks give you 10 years, while others might give you up to 20 years to finish. Pick a plan that allows you to live comfortably while paying for your home.

You also need to think about the location of the property you want to buy. Most non-interest banks in Nigeria prefer homes in developed areas with good titles. Make sure the house has a “Certificate of Occupancy” so the bank can approve your halal property financing Nigeria request. It is also wise to speak with a financial advisor who understands Islamic financial principles. They can help you read the fine print and make the best choice for your family.

Comparison Criteria: Rates, Tenure, Down Payment & More

When comparing different banks, focus on the “profit margin” rather than an interest rate. The profit margin is the amount the bank adds to the property’s purchase price as compensation for its services and financing structure. You must also check the down payment requirement Nigeria for each specific bank you visit. Most banks will ask you to pay between 10% and 30% of the house price upfront. This shows the bank that you are serious and ready for home ownership financing Nigeria.

| Feature | Non-Interest Mortgage | Conventional Mortgage |

| Profit Type | Fixed Markup or Rent | Variable Interest |

| Ownership | Joint Partnership | Borrower owns (Bank holds lien) |

| Late Fees | Usually Donated to Charity | Kept by Bank as Profit |

| Risk | Shared between Bank and Buyer | Carried mostly by Buyer |

Top 5 Non-Interest Banks Offering Halal Mortgages in Nigeria (2026)

Jaiz Bank — Overview, Key Features & Offerings

Jaiz Bank is the pioneer of Islamic banking Nigeria 2026 and has a very strong reputation. They offer a great Murabaha home financing Nigeria product that is easy to understand. You can get a long mortgage tenure options plan that fits your salary perfectly. They are known for being very helpful to first-time buyers who are new to Sharia-compliant mortgage Nigeria. Their Sharia advisory board ensures every single step is 100% ethical and transparent.

If you want a broader comparison beyond mortgages, check our complete list of Islamic banks in Nigeria to see all licensed non-interest financial institutions.

The Alternative Bank (Sterling) — Why It Stands Out

This bank is famous for its “Alt-Home” product, which is very modern and fast. They use a rent-to-own Islamic mortgage model that lets you move in quickly. Their digital tools make it easy to track your profit-sharing agreement from your phone. If you want a bank that feels like a tech company, this is one of the best halal mortgage options in Nigeria in 2026. They focus on making interest-free home loan Nigeria applications simple and stress-free.

TAJBank — Rates & Unique Benefits

TAJBank offers some of the most competitive halal mortgage rates Nigeria 2026 in the country right now. They often provide special discounts if you have a salary account with them already. Their Diminishing Musharakah model is very fair and helps you own your home faster. They are one of the most popular non-interest banks in Nigeria because of their friendly staff. You will find that their Islamic housing finance eligibility criteria are quite reasonable for most workers.

Lotus Bank — Ethical and Local Focus

Lotus Bank is deeply committed to “Ethical Prosperity” and supporting local Nigerian communities. They offer a unique Ijara mortgage Nigeria plan that is perfect for families who want to lease-to-own. Their asset-backed financing ensures that your investment is safe and secure for the long run. They are a top choice if you want a bank that cares about your personal growth. Many people ask, “Which bank offers non-interest mortgage in Nigeria?” and Lotus is always a top answer.

Stanbic IBTC (Islamic Window) — Corporate Stability

Even though they are a large bank, their Islamic window is very specialized and professional. They provide a zero-interest housing loan that is backed by years of global banking experience. Their Sharia advisory board is made of world-class scholars who check every deal. This is a great option if you are looking for a high-value halal property financing Nigeria deal. They offer some of the best mortgage tenure options for high-income earners in 2026.

Detailed Comparison: Halal Mortgage Rates & Terms (2026)

Comparative Table of Rates & Fees

| Bank | Estimated Profit Margin | Min. Down Payment | Max Tenure |

| Jaiz Bank | 16% – 19% | 20% | 10 Years |

| The Alternative Bank | 15% – 18% | 20% | 15 Years |

| TAJBank | 15% – 20% | 25% | 12 Years |

| Lotus Bank | 14% – 18% | 20% | 10 Years |

| Stanbic IBTC | 9.75% (MREIF) | 10% | 20 Years |

Tenure & Down Payment Comparison

When you compare Islamic mortgage rates Nigeria, you will see that terms vary a lot. The down payment requirement Nigeria is usually the biggest hurdle for most people. Some banks like Stanbic IBTC offer a 10% equity option if you use their special funds. However, most non-interest banks in Nigeria prefer a 20% deposit to keep the monthly rent low. Longer tenures mean smaller monthly payments, but you will pay more in total profit over time.

Profit Sharing vs. Fixed Margin Structures

You must decide if you want a fixed price today or a sharing model. The Murabaha home financing Nigeria model gives you a fixed price that never changes. This is great for people who want to know exactly what they will pay every month. On the other hand, the Diminishing Musharakah model allows your rent to go down as you own more of the house. Both are great Sharia-compliant mortgage Nigeria options, so choose the one that makes you feel most secure.

Eligibility Requirements for Halal Home Financing

Income & Documentation Requirements

To qualify for an Islamic home finance Nigeria plan; you must demonstrate a consistent ability to manage your money. Non-interest banks in Nigeria prioritize your financial stability to ensure you can honor a profit-sharing agreement. By having these documents needed for halal mortgage Nigeria ready, you prove that you are a reliable partner for ethical home financing.

Here is a breakdown of the core requirements for Islamic home loan in Nigeria:

- Constant Income Check: You should demonstrate that you have worked or owned a business at least two-five years. With salaried workers, this entails giving your letter of employment and your three latest monthly pay-slips.

- Financial Transparency: Banks must have six or twelve months of bank statements with a stamp of your financial institution. These assertions demonstrate your expenditure patterns and display that you will be in a position to meet the monthly payments of a Sharia-compliant mortgage Nigeria.

- Identity and Residency Documents: You are required to present a valid government issued ID, which is an International Passport, National ID (NIN) or a Drivers License. Also, to confirm the home address, a utility bill within the past three months will be needed.

- Bank Verification Number (BVN): BVN is a requirement in all home ownership financing Nigeria loans. It enables the bank to check your financial identity in the whole banking system of Nigeria at a go.

- Credit Bureau Report: Banks will examine your past with agencies such as CRC Credit Bureau even with a zero-interest loan of a house. The Islamic housing finance eligibility requirements would involve having a clean record with no defaults on past loans.

- Business Documentation (Self employed): You need to provide your CAC registration certificate, and three years of clearance certificate of tax in case of a business owner. Other banks request audited financial statements to enable them to know that your business is profitable.

- Property Title Papers: Bank must be shown the Certificate of Occupancy (C of O) or Governor Conent of the house you are going to purchase. The bank cannot take asset-backed financing to place without a legally valid title.

Required Documents Summary Table

| Document Type | Salaried Individuals | Self-Employed/Business Owners |

| Identity | Valid ID (Passport/NIN/DL) | Valid ID + CAC Registration |

| Income Proof | 3-6 Months Pay slips | 3 Years Tax Clearance |

| Bank History | 6 Months Salary Statements | 12 Months Business Statements |

| Verification | BVN + Employer Letter | BVN + Audited Accounts |

Credit Criteria (Sharia-compliant Measures)

The Islamic housing finance eligibility criteria focus on your ability to keep a promise. These banks check your credit history to see if you pay your bills on time. They don’t use interest-based scores in the same way, but they still want to see financial responsibility. If you have a clean history with other non-interest financial institutions, your chances are very high. They want to ensure that getting a halal home financing deal doesn’t put too much pressure on your family.

Step-by-Step Guide to Applying for a Halal Mortgage

- Build Your Equity Base The journey begins by saving for your down payment requirement Nigeria. Most non-interest banks in Nigeria require you to have at least 20% of the property value ready in your account. This “equity” shows the bank you are financially disciplined and ready for a profit-sharing agreement.

- Get Your Pre-Qualification Visit your preferred bank, such as Jaiz Bank or Lotus Bank, to obtain a “Pre-Qualification” letter. They will review your income & documentation requirements to tell you exactly how much they can fund. This step helps you shop for a house within a realistic budget.

- Find a Bankable Property Search for a home that fits your pre-approved budget. Crucially, ensure the property has a “clean” government title like a Certificate of Occupancy (C of O). In halal property financing Nigeria, the bank must approve the asset’s legal status before they agree to the asset-backed financing.

- Undergo Independent Valuation Once you find a house, the bank will send an independent surveyor to check its condition and market value. This protects you from overpaying and ensures the Diminishing Musharakah model is based on a fair price.

- Sign the Islamic Contract After the bank’s approval, you will sign the Islamic contract structures. These documents clearly outline the rent-to-own Islamic mortgage terms, including the monthly rental and your path to full ownership.

- Disbursement and Move-In You pay your 20% deposit, and the bank pays the remaining 80% to the seller. The property is then handed over to you! You begin your monthly payments, gradually buying back the bank’s share until you are the sole owner.

Comparison of Requirements for Top Nigerian Banks (2026)

| Bank Name | Key Requirement | Estimated Processing Time |

| Jaiz Bank | Salary account for 6 months | 4 – 8 Weeks |

| The Alternative Bank | Digital application via App | 2 – 4 Weeks |

| Lotus Bank | Proof of ethical business | 4 – 6 Weeks |

| TAJBank | Minimum 25% Equity | 3 – 5 Weeks |

Applying for a halal mortgage in Nigeria today is more about partnership than simple borrowing.

Common Challenges & How to Avoid Them

Sometimes, the documents needed for halal mortgage Nigeria can take a long time to gather. You can avoid this by keeping all your tax papers and bank statements in one folder. Another challenge is finding a property with a perfect title that the bank accepts. Always work with a professional real estate agent who knows about Sharia-compliant mortgage Nigeria requirements. They can save you months of waiting by showing you the right houses from the start.

Lastly, some people worry about whether is halal mortgage cheaper than conventional loan? While the total cost might be similar, the halal mortgage rates Nigeria 2026 are much more stable. You won’t be surprised by “floating interest rates” that change when the economy fluctuates. This stability is a huge advantage that helps you plan your future with confidence. Staying organized and patient is the key to a successful interest-free home loan Nigeria experience.

Conclusion & Best Picks for 2026

Choosing a halal mortgage Nigeria 2026 plan is a smart move for your family’s future. You get to own your dream home while following Islamic financial principles that promote fairness. If you want the lowest down payment, Stanbic IBTC is a strong contender for your business. For the most traditional and trusted experience, Jaiz Bank remains a top leader in the field. Every bank on our list offers a unique way to achieve ethical home financing in Nigeria.

Take a moment to visit their websites and compare Islamic mortgage rates Nigeria for you. Your journey to home ownership doesn’t have to be a burden of debt and interest. With the right non-interest banks in Nigeria, you can build a home and a legacy at the same time. Start your application today and take the first step toward a Riba-free housing finance future. A stable home built on ethical finance gives your family long-term security.

If you’re not ready for property ownership yet, you may start with smaller ethical investments through the best Halal Investment Companies in Nigeria before committing to a mortgage.

FAQS

Are these housing loans only available to Muslims in Nigeria?

No, anyone can access Islamic home finance Nigeria products regardless of their faith as long as they meet the bank’s income rules.

Does the Federal Mortgage Bank of Nigeria offer a non-interest option?

Yes, the FMBN provides a Sharia-compliant “Rent-to-Own” product for Nigerian workers who contribute to the National Housing Fund.

Can I pay off my halal mortgage earlier than the scheduled date?

Yes, most non-interest financial institutions allow early settlement and some may even offer a discount on the remaining profit markup.

Is a halal mortgage a good way to get a zero-interest housing loan?

It is an excellent choice for those seeking a zero-interest housing loan because it focuses on asset-backed partnerships rather than lending money for profit.

Are there penalties for finishing my payments ahead of time?

Unlike conventional loans, halal property financing Nigeria usually does not charge penalties for early exit, though you should confirm with your specific bank.

What is the most important requirement for the FMBN non-interest loan?

The most vital requirement is being a consistent contributor to the National Housing Fund and meeting the standard Islamic housing finance eligibility criteria.